KARACHI: Heavy selling marked trading at the Pakistan Stock Exchange (PSX) on Monday as the benchmark KSE-100 index gave up early gains and plunged nearly 5,500 points in panic selling over geopolitical tensions and domestic political and economic uncertainty. In the morning, the market opened on a relatively firm note, with the index climbing to the intra-day high of 174,337 during early trading. However, the positive momentum proved short-lived and profit-taking emerged at higher levels, pushing the index on a steady downward trajectory. Market confidence got a hit as investors…

Read MoreCategory: bussines

Oil near 7-month high on US-Iran tensions

NEW YORK/LONDON/SINGAPORE: Oil prices were little changed near a seven-month high on Tuesday as traders waited for news from nuclear talks between the US and Iran. Brent futures fell 25 cents, or 0.4%, to $71.24 a barrel at 1541 GMT, while US West Texas Intermediate crude fell 25 cents, or 0.4%, to $66.06. Earlier in the session, Brent was on track for its highest close since July 31 and WTI was on track for its highest close since August 1. As part of the highest-level US visit to Caracas focused…

Read MorePTCL posts Rs9.7b consolidated loss

ISLAMABAD: Pakistan Telecommunication Company Limited (PTCL) has announced that its consolidated revenue for the year ended December 31, 2025 increased by 12%, driven by strong performance in fixed broadband, enterprise, wholesale and mobile services. The company’s consolidated operating profit grew by 216% year-on-year (YoY), underscoring strong operational performance. For the year, however, a net loss of Rs9.7 billion was recorded, primarily driven by accelerated expected credit loss (ECL) provisioning at Ubank following revisions to Prudential Regulations. PTCL’s revenue grew by 12% YoY, led by a 50% growth in Flash Fibre…

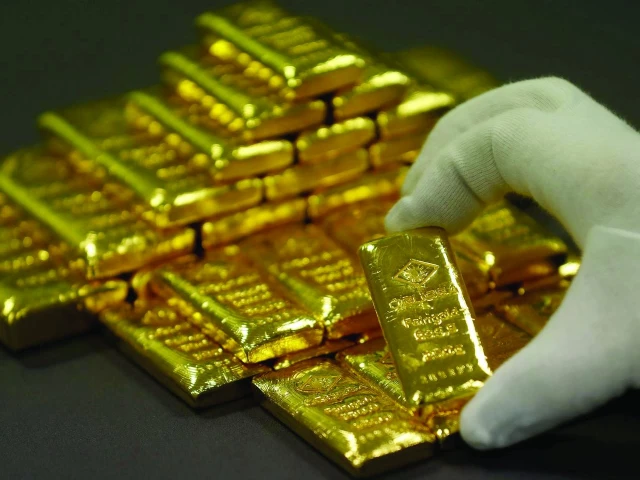

Read MoreGold up Rs3,400/tola despite global pullback

KARACHI: Gold prices in Pakistan extended their upward trend on Tuesday, tracking volatility in the international bullion market where prices slipped from a three-week high amid profit-taking and a stronger US dollar, while investors monitored geopolitical tensions between Washington and Tehran and awaited clarity on the US tariff policy. In the local market, the price of 24-karat gold rose by Rs3,400 per tola to Rs539,962, according to rates issued by the All-Pakistan Gems and Jewellers Sarafa Association. Similarly, the price of 10 grams increased by Rs2,915 to Rs462,930. The latest…

Read MorePakistan, Turkmenistan discuss regional energy links

ISLAMABAD: Federal Minister for Energy (Power Division) Sardar Awais Ahmed Khan Leghari on Tuesday met Turkmenistan’s Ambassador to Pakistan, Atadjan Movlamov, with discussions focusing on regional energy connectivity and cross-border cooperation between Pakistan and Central Asia. According to an official statement, the meeting took place at the Ministry of Energy, where the minister welcomed the ambassador and exchanged greetings on the occasion of Ramazan, conveying goodwill and best wishes for peace and prosperity for the peoples of both countries. The Turkmen envoy highlighted the historical and cultural links between Pakistan…

Read MoreSMEDA offers 70% grant for certifications

LAHORE: The Small and Medium Enterprises Development Authority (SMEDA) has launched a 70% matching grant under its SME Certification and International Accreditation Grant Programme to help businesses obtain internationally recognised certifications and improve export competitiveness. According to a statement issued on Tuesday, the programme has gained traction as entrepreneurs from several parts of the country have shown interest in obtaining globally recognised certifications to enhance their competitiveness and export potential. SMEs will bear 30% of the cost, while the grant will cover certification expenses up to Rs800,000 and consultancy costs…

Read MoreForeign firms invest Rs41b

ISLAMABAD: Seventy nine new foreign companies have commenced operations in Pakistan over the past three years while international companies invested Rs40.7 billion in key sectors during the same time period. According to a statement released by the Securities and Exchange Commission of Pakistan (SECP), 61 foreign companies have also carried out shareholding transactions involving local entities. Of these transactions, 29 involved shareholding transfers to other foreign companies, four deals pertained to transfers to foreign individual investors, 20 were related to local individual investors and eight comprised local corporate entities. “Pakistan…

Read MorePSX falls further in absence of cues

KARACHI: Losses deepened at the Pakistan Stock Exchange (PSX) on Tuesday as the benchmark index closed lower by around 1,450 points over persistent selling and cautious investor sentiment in the absence of near-term positive cues. It came following a steep fall of around 5,500 points a day ago, when market players offloaded their holdings in panic mainly due to the evolving geopolitical situation. On Tuesday, the market opened in the green and staged a brief early rally, pushing the KSE-100 index to the intra-day high of 169,238. However, the positivity…

Read More$2b rollover status remains unclear

ISLAMABAD: Pakistan has received over $10 billion in foreign loans, half of it in fresh disbursements and the remainder in rollovers of existing debts, but the central bank has yet to announce the status of the $2 billion rollover by the United Arab Emirates (UAE). According to Ministry of Economic Affairs data, the federal government received $5.1 billion in fresh loans during the July-January period of the current fiscal year. In addition, Saudi Arabia, China and the International Monetary Fund (IMF) either disbursed funds or rolled over $5 billion worth…

Read MoreDebt and taxes haunt economy

BRUSSELS: Debt and taxes are throttling Pakistan’s economy. Pakistan’s never ending fiscal profligacy is the underlying reason why we keep going in the intensive care unit asking the same medical team (read: IMF) who keep giving us the same set of treatments, albeit with more powerful medications only to cure our symptoms and failing to cure our disease. Once the medical team is satisfied that the patient has “stabilised” and out of the intensive care unit and into the recovery room, they will continue to monitor the recovery over a…

Read More